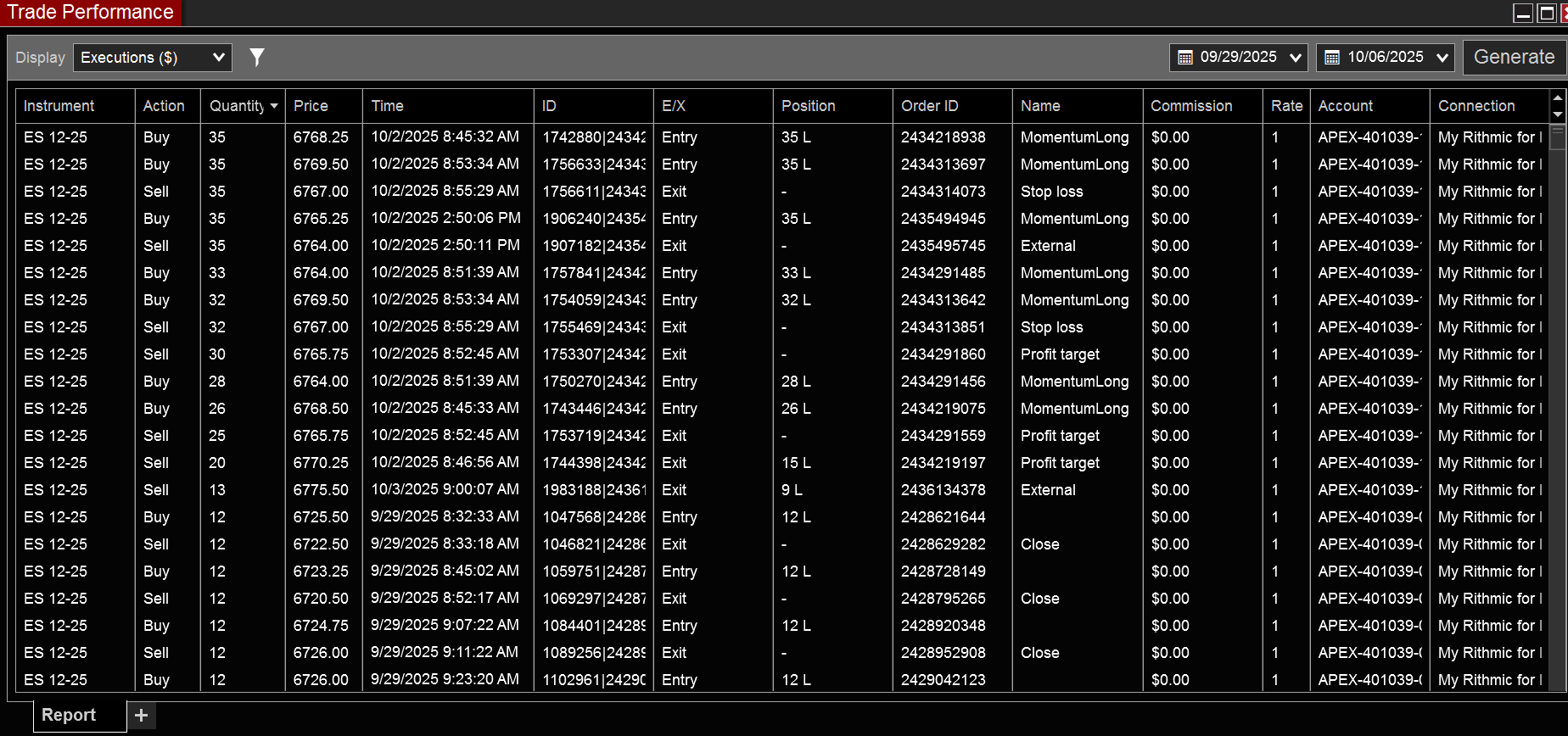

Algo TradingEfficient execution and systematic trading are a more disciplined approach with a Trading Bot. Having rules programmatically output executions make for exponential gains. A more disciplined approach to orders and executions are a systematic feature of Trading Bots with Automated Trades.

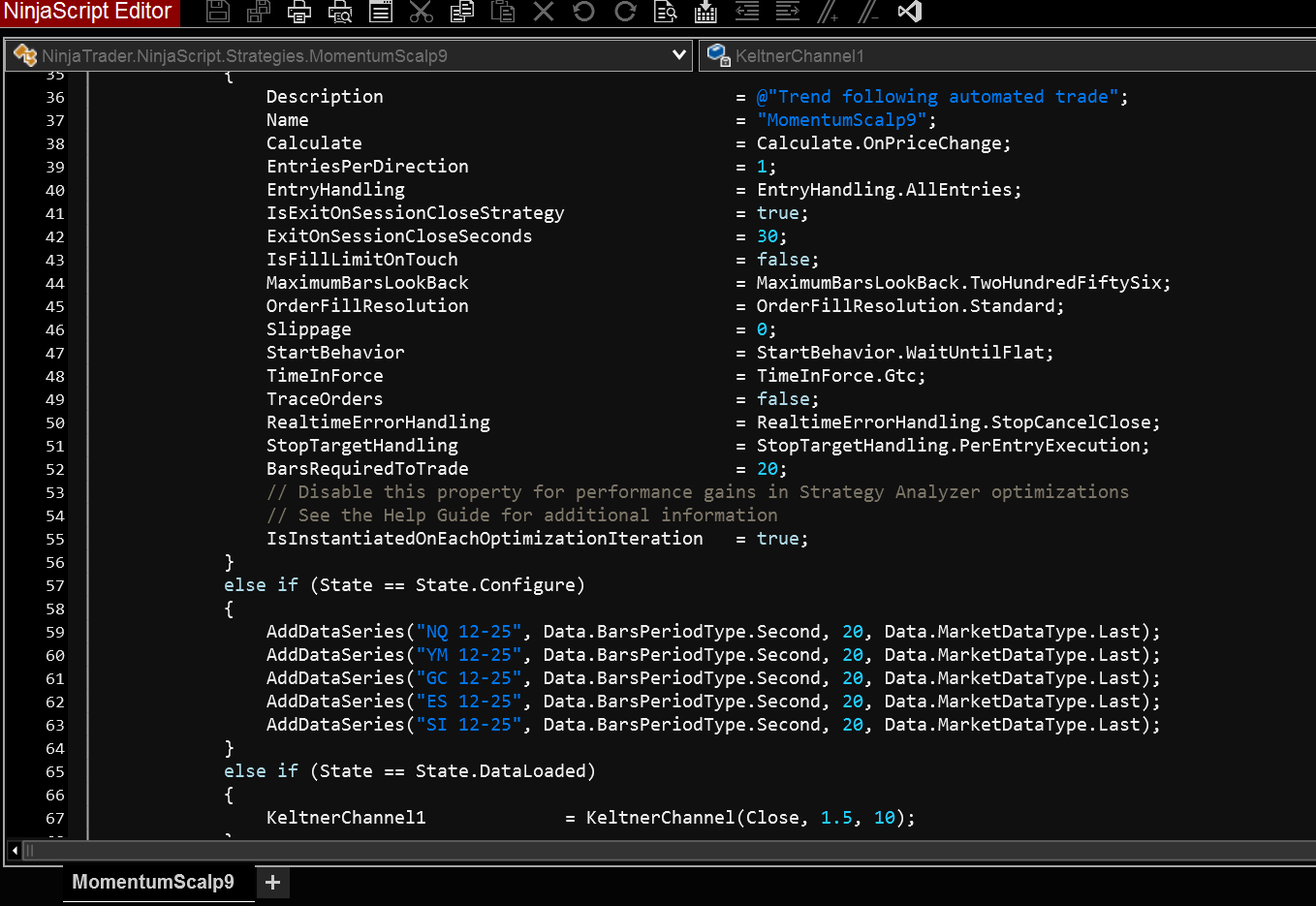

emotion free tradingAI learning and machine learning that uses mathematical models (Quantitative Trading) to analyze data and manage trades removes emotion from the equation. Instant math calculations with AI learning output calculations in fractions of a second. Time frames of 10 Seconds, 20 Seconds, 1 Minute, and 5 Minutes are used in emotion free Quantitative Trading with Automated Trades. Custom Indicators used are Keltner Channel, Bollinger, EMA (Exponential Moving Average), and SMA (Simple Moving Average).

Emotion free trading through Algorithmic (Algo) Trading. A work-load that human intuitive based trading can’t match. Having the stop-losses in mind effects bias and makes for over reaction in holding a position too long or selling too fast. Emotion free trading is the key feature supplied by Algo Trading with Automated Trades.

Trading Bot